Innovation is transforming our lives. Whether you’re meal planning (Blue Apron), picking up batteries (Amazon), hailing a cab (Uber), deciding on your next do-it-yourself project (Pinterest), or shopping for non med life insurance, our experience is nothing like it used to be.

Change is the only constant. -Heraclitus, Greek philosopher

These words were said in the late 6th century, BC. And, they are just as true today as they’ve ever been. Fortunately, most would argue that the changes happening have improved our lives.

Purchasing life insurance coverage is no exception. In the past, the industry was associated with pushy salesmen and limited options:

Times are changing in both the shopping experience and the options available. No exam life insurance has evolved, for sure.

In fact, less than 10 years ago, many life insurance agents would have recommended against a non med (no exam) policy. However, life insurance carriers have been paying attention to the needs and wants of their potential clients. They’re adjusting their rates and offering new options.

Policies that don’t involve a medical exam are more affordable and easier to secure than ever before.

Here’s great news: If you have rheumatoid arthritis (RA), and the thought of going through a medical exam makes your stomach churn, it’s possible there’s a no exam life insurance policy you can qualify for.

What Is No Exam Life Insurance?

Can I Get No Exam Life Insurance With Rheumatoid Arthritis?

When Does No Exam Life Insurance Not Make Sense?

What Questions Will The Life Insurance Company Ask Me?

Sample Quotes For No Exam Life Insurance With RA

Bottom Line

Apply For No Exam Life Insurance

What Is No Exam Life Insurance?

Essentially, no exam life insurance, also known as non med, is a life insurance policy that doesn’t require a medical exam to purchase the policy.

Let’s consider five essentials about no exam life insurance.

- It’s now affordable. In the past, no exam life insurance was expensive compared to traditional life insurance. Most life insurance experts would recommend completing a slightly uncomfortable paramedical exam in order to get the best rates. Not the case anymore. It turns out there’s quite a few of us who have no interest in being poked with a needle or, ahem, using the restroom in a cup. Prices have dropped and are comparable to traditional rates, up to about $500,000 in coverage.

- Meaning of non med life insurance: can vary slightly depending on the life insurance carriers you apply with. For example, some carriers will order additional medical records and tests (possibly blood work) depending on your age and/or phone interview. On the other hand, some carriers offer policies with no testing under any conditions. Generally, non med life insurance means no needles and no nurses.

- When it makes sense: depends on your overall health. Just because this type of insurance doesn’t involve a medical exam, not just anyone can qualify. You will need to be in overall satisfactory health.

- If you haven’t seen a physician in a few years and are concerned about possible red flags in your blood work, no exam can especially make sense.

- Or, if you are in need of a policy in a hurry, no exam life insurance can shave weeks off of the turnaround time.

- Of course, if your thoughts around needles could be best described as dread, this type of policy makes all the sense in the world.

- Steps to purchase a no exam policy:

- Partner with an independent life insurance agent. This is the most important first step because all policy options can be explored.

- Complete the life insurance application, typically over the phone or online. Medical records and/or additional testing may be ordered at this point depending on the carrier, your age and your health status.

- Signatures will complete the contract.

- Work with an independent life insurance agent. An independent agent is one that isn’t held captive to a specific life insurance carriers. This means all life insurance policies can be shopped and your best interest is at heart. Your needs will determine which life insurance carriers to work with, potentially saving you thousands of dollars over the life of the policy.

Can I Get No Exam Life Insurance With Rheumatoid Arthritis?

In short, yes.

While many non med life insurance companies won’t offer policies to those of us with rheumatoid arthritis, there are a few who will.

Here’s what you need to know:

- No exam life insurance options are ideal for someone who has mild to moderate rheumatoid arthritis.

- The severity of your RA is important to consider.

- Mild to moderate RA means zero to minimal deformity, milder medications, and an effective treatment plan.

- Not all with RA will qualify for no exam life insurance.

- You will need to be in overall satisfactory health.

- For example, if you have been diagnosed with cancer, heart disease, or have had a stroke, this type of policy is not a good fit.

- There are some prescription medications that are red flags to non med carriers. If you take the following medications, it will be difficult to secure no exam life insurance:

- Enbrel

- Remicade

- Humira

- Life insurance carriers will want to take a look at your medical records.

When Does No Exam Life Insurance Not Make Sense?

For many with RA, no exam life insurance will not make sense. And, that’s okay.

What you need to know: There are always life insurance options for you, regardless of the severity of your rheumatoid arthritis.

Let’s look at a couple examples of those who would likely not qualify for non med life insurance.

- Richard was diagnosed with RA eight years ago. Since his diagnosis, Richard has flareups on a monthly basis. He is unable to work regularly. His rheumatologist prescribed him Enbrel to manage joint pain and stiffness. Richard needs to take prednisone to combat inflammation.

- Jane was diagnosed with RA 15 years ago. She has deformities of her toe joints and is unable to walk or stand for long periods of time. Jane’s rheumatologist prescribed her Remicade to reduce inflammation. She experiences flareups regularly. Jane has been diagnosed with depression due to her struggles to manage her rheumatoid arthritis.

Common reasons no exam life insurance with RA will not be an option:

- You are prescribed Enbrel, Remicade, or Humira.

- You have a major disability as a result of your RA and are unable to work.

- You have a deformity as a result of your RA and are unable to stand or walk for extended periods of time.

- Your RA has affected your major organs, like your lungs.

What Questions Will The Life Insurance Company Ask Me?

Non med life insurance interviews typically only involve a phone interview.

Before your interview starts, be prepared to answer the following:

- Age/Date Of Birth

- Gender

- Height/Weight Ratio

- Tobacco Use

- Medical History (i.e. surgery, pregnancy, major illness)

- Family Medical History (i.e. diabetes, cancer, heart disease)

- Medications

- Lifestyle (i.e. alcohol, drug use)

- Financial Information (i.e. annual income, history of bankruptcy)

- Hobbies (i.e. scuba diving, mountain climbing)

Specific to RA, you will be asked:

- Date of Diagnosis: because RA is considered a chronic condition, insurance companies want to know how long you have been treating RA. Their concern is the longterm effects drugs used for RA management has on the body.

- Duration and Frequency Of Flareups: the more often you have flareups, and how long they last, increases your risk for joint and tissue damage.

- Deformity from RA: insurance companies want to know if you have (and what type) a deformity. For example, a mild deformity of the wrists or fingers or a major deformity of the knees or hips.

- Disability from RA: the inability to live independently and perform the daily activities of living, due to a disability, negatively affects your life insurance rating.

- Parts of the Body Affected by RA: areas of the body, and to what degree affected by RA. For example, mild wrist pain or lung and kidney damage.

- Medications Used to Treat RA: how often and what type of drugs used in your treatment plan (i.e. NSAIDS, Methotrexate).

Keep in mind: your health must be decent in order to qualify for no exam life insurance. And, your rheumatoid arthritis needs to be mild and easily managed. If, after the phone interview, the life insurance carrier notices some areas of concern, you may be asked to followup with lab work.

Sample Quotes For No Exam Life Insurance With RA

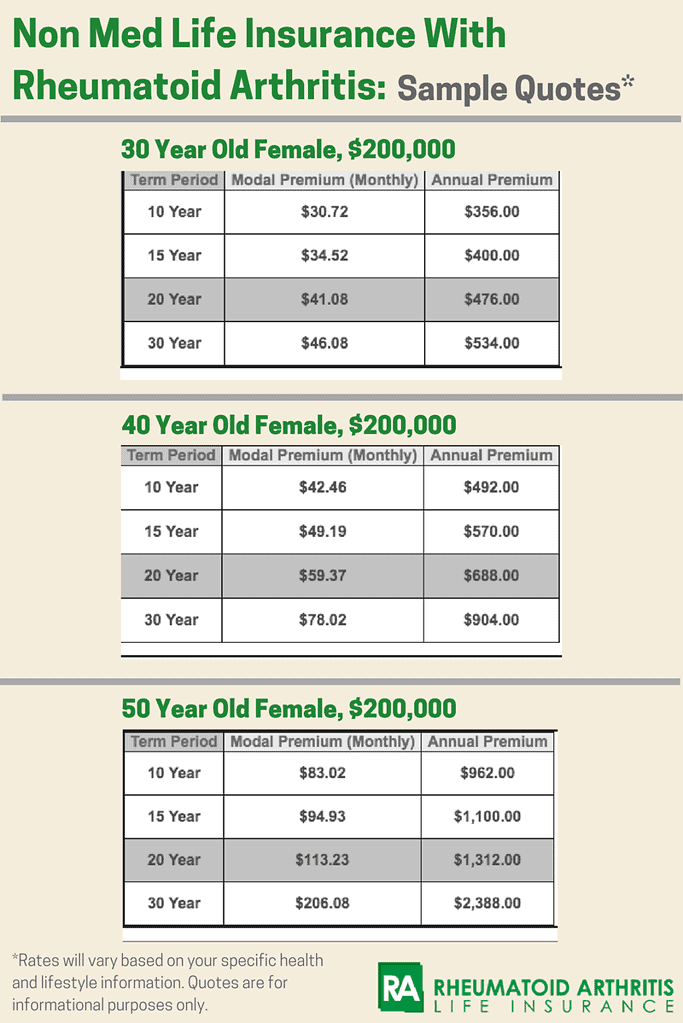

For a general idea, let’s say an overall healthy female with mild rheumatoid arthritis was quoted for $200,000 of non med life insurance at different ages:

Remember, life insurance rates will vary. Sample quotes are intended for informational purposes. Your age, health and lifestyle factors affect your personal rates.

Bottom Line

It’s not fun to sound dark or to discuss the possibility of tragedy striking. In fact, most avoid it like the plague – paradox intended! Our 16th President, Abraham Lincoln, offered some sage advice on the topic.

You cannot escape the responsibility of tomorrow by evading it today. -Abraham Lincoln

If you have loved ones that depend on you financially, it’s your responsibility to be prepared to care for them, regardless of life brings your way. For most, that includes purchasing life insurance.

Apply For No Exam Life Insurance

We specialize in working with clients with rheumatoid arthritis find the highest quality protection at the best prices available. If you have RA and are shopping for life insurance, it’s crucial to collaborate with an agent with a deep understanding of RA.

At Rheumatoid Life Insurance, our job is to be your advocate. As an independent life insurance agency, we will cross-reference the top-rated life insurance companies to find the best rate for which you can be approved.

Fill out our Instant Quote form to get started.

Speak with an experienced advisor!

Speak with an experienced advisor!